About AIPF

The Need for Project Preparation Funding

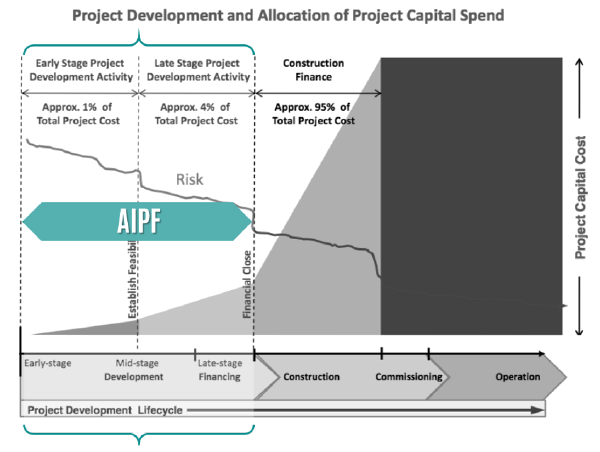

AIPF Funding Focus

Infrastructure Project Preparation Facilities Principles for Success

Clear objectives and a focussed strategy

A self-sustainable financing model

Excellence in portfolio management

Cost-efficient and value-adding advisory services

Stringent governance and accountability

AIPF Strategic Objectives

Complement financial and institutional resources from like-minded investors for the preparation of infrastructure projects.

Focus on project preparation with emphasis on feasibility studies, assessment of institutional, technical, financial, environmental, legal and social modules of the project and the key promotor.

Improve the risk/return profile for investors through diversification of portfolio and set criteria for country exposure limits.

Shorten the approval times of project preparation, thereby lowering the transactional costs of project preparation.

Increased throughput of projects to financial close as a result of improved project screening, selection and modelling.

Unlock project opportunities through origination capabilities.

Leveraging concessional and grant funding for the Facility.

Capitalise on existing relationships with entities and professional service providers in Africa.

Focus on best risk management practices.

Adhere to sound governance principles.

To stimulate economic activity and social development on the African continent by enabling infrastructure development.

It is the vision of AIPF to stimulate economic activity and social development on the African continent by enabling infrastructure development. This is defined by AIPF as its Development Impact. With this end in mind, AIPF maintains an emphasis on the socio-economic impact and sustainability of the infrastructure projects it will unlock on the continent. This is reflected in AIPF’s investment mandate. The necessity of infrastructure in the African context is driven by the need for sustained social upliftment and economic growth in societies across the continent,

and its implementation impacts on the socio-economic landscape around a project. AIPF considers it critical to address socio-economic risks and opportunities on a local level in the early stages of project development. The development impact considerations of AIPF specifically consider the social elements of globally recognised ESG criteria, focusing on the impact of its business on local communities and stakeholders, and the economic, social and environmental sustainability of its infrastructure project portfolio.

Throughout the project screening and selection process, the development impact of each project is assessed and opportunities for increasing socio-economic benefits are explored. Through this approach, the pipeline of fundable projects generated by AIPF is an appealing destination for development finance institutions, socially responsible investors, impact investors, and donors.

A focus on development impact

- encourages sustainable development practices throughout the infrastructure development lifecycle;

- encourages blended funding and cooperation between different parties in the investment spectrum, as both socio-economic value and financial returns on the portfolio are prioritised; and

- provides an opportunity for the private sector to generate more value for its portfolio of projects, for investors and for society at large.